Core Banking Services

Core Banking Services

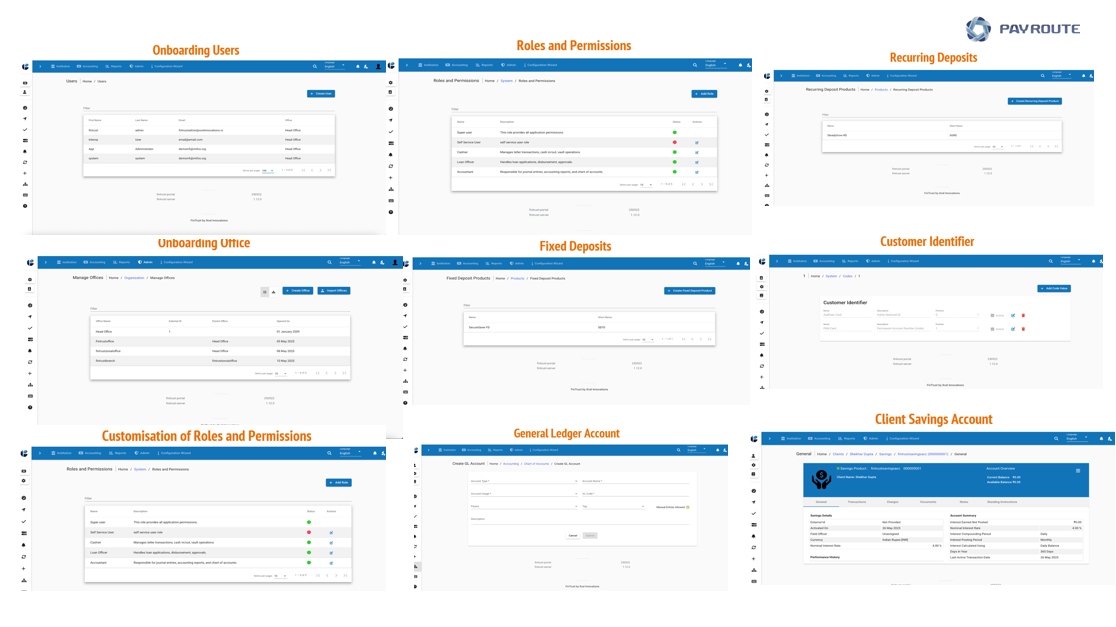

PayRoute offers a wide range of banking services, such as savings and checking accounts, loans (personal, business, and mortgages), credit cards, investment services, and electronic banking options like online and mobile banking.

Our Banking Software Services Help You:

- Core Banking Solutions.

- Mobile Software Development with top security solutions.

- User-friendly interfaces.

- Mobile applications.

- Tech solutions for loan management.

- Data security.

- Wealth management.

- Business processes and financial transactions.

Banking Software Services

Project Management

- Define project goals.

- Identify key requirements and expectations.

- Identify stakeholders and their needs.

- Create a project plan.

Comprehensive Analysis & Documentation

- Conduct detailed analysis.

- Create functional & technical documentation.

- Analyse risks and develop a risk management plan.

- Define scope, budget, and timeline.

Planning & Design

- Design the system architecture.

- Create UI/UX prototypes and mock-ups.

- Develop a detailed implementation plan.

Implementation

- Program and configure the system.

- Run regular reviews and progress reporting.

- Manage change.

- Ensure quality control.

Deployment & Maintenance

- Prepare the deployment plan.

- Train end-users.

- Deploy in the production environment.

- Provide post-deployment monitoring and support.

Testing & Verification

- Verify compliance with requirements.

- Conduct unit, system, integration & acceptance testing.

- Identify and fix errors.

Banking Software Development

| Industry: | Banking Software Development |

| Platforms: | WebPortal |

| Focus: | It measures the work that goes into a project from beginning to end. |

| Nature of Deliverables: |

Accepting deposits, lending money, facilitating transactions, and offering various financial products

like savings accounts, loans, and credit cards which meet all security and compliance needs. |

| Duration: | 18 Months |

Security and Compliance

- Robust Encryption: Advanced encryption to protect sensitive customer data.

- Secure Authentication: Strong methods such as multi-factor authentication.

- Regular Security Audits: Frequent evaluations to uncover and address vulnerabilities.

- Compliance with Regulations: Adherence to standards and requirements (e.g., GDPR, CCPA, SOX, NPCI).

Documents Download